[ad_1]

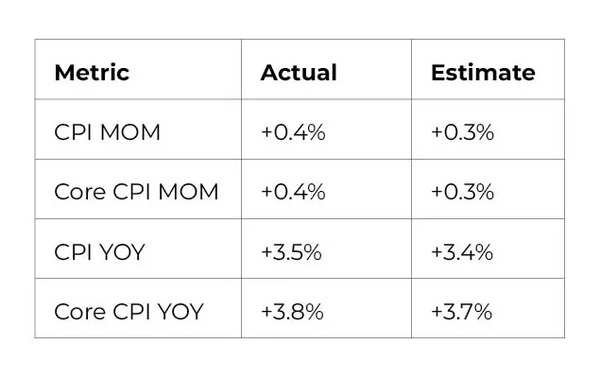

The so-called core shopper worth index, which excludes meals and power prices, elevated 0.4% from February, based on authorities information out Wednesday. From a yr in the past, it superior 3.8%, holding regular from the prior month.

Economists see the core gauge as a greater indicator of underlying inflation than the general CPI. That measure climbed 0.4% from the prior month and three.5% from a yr in the past, an acceleration from February that was boosted by greater power costs, Bureau of Labor Statistics figures confirmed.

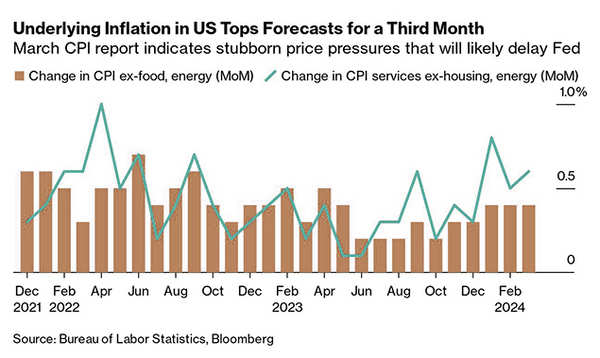

Wednesday’s report provides to proof that progress on taming inflation could also be stalling, regardless of the Fed protecting rates of interest at a two-decade excessive. With a robust labor market nonetheless powering family demand, officers have been adamant they’d wish to see extra proof that worth pressures are sustainably cooling earlier than reducing borrowing prices.

Treasury yields and the greenback jumped whereas S&P 500 index futures tumbled. Swaps merchants slashed the diploma to which they see the Fed will minimize charges this yr. Minutes from the Fed’s assembly final month will likely be launched later Wednesday.

“The sound you heard there was the door slamming on a June price minimize. That is gone,” David Kelly, JPMorgan Asset Administration’s chief world strategist, mentioned on Bloomberg Tv.

Core CPI over the previous three months elevated an annualized 4.5%, essentially the most since Could.

Gasoline and shelter accounted for over half of the general month-to-month advance, the BLS mentioned. Prices for automotive insurance coverage, medical care and attire elevated within the month, whereas costs for brand new and used vehicles fell.

Shelter costs, which is the biggest class inside companies, rose 0.4% for a second month. Homeowners’ equal hire — a subset of shelter, which is the most important particular person part of the CPI — climbed by that a lot as nicely.

Excluding housing and power, companies costs accelerated to 4.8% from a yr in the past, essentially the most since April 2023, based on Bloomberg calculations. Whereas central bankers have careworn the significance of such a metric when assessing the nation’s inflation trajectory, they compute it based mostly on a separate index.

That measure, often known as the non-public consumption expenditures worth index, does not put as a lot weight on shelter because the CPI does. That is a part of the rationale why the PCE is trending a lot nearer to the Fed’s 2% goal.

Policymakers could have entry to at least one extra PCE report, in addition to one other have a look at the producer worth index, earlier than their subsequent coverage assembly concludes on Could 1. Fed officers have successfully dominated out a price minimize then.

“Regardless that the Fed does not goal CPI, it’s another excuse for delaying any price cuts and/or lowering the quantity anticipated this yr,” mentioned Kathy Jones, Charles Schwab’s chief fixed-income strategist. “If service sector inflation is sticky, then it does not depart a lot room to ease.”

Not like companies, a sustained decline within the worth of products over many of the previous yr has largely been offering some reduction to customers — although economists count on that to be a much less dependable supply of disinflation going ahead. So-called core items costs, which exclude meals and power commodities, fell 0.2% within the month.

With power costs additionally again on the rise, it is unclear the place the following large drag on inflation will come from. Economists have lengthy been anticipating some easing in shelter worth progress, however thus far, that hasn’t actually occurred but.

Policymakers have additionally been hesitant to chop rates of interest given the power of the labor market, particularly after final week’s jobs report confirmed strong hiring and the unemployment price fell. A separate report Wednesday confirmed actual earnings progress decelerated, rising on the slowest annual tempo since Could.

That is helps clarify why President Joe Biden’s approval scores are struggling for momentum going into this yr’s presidential election.

[ad_2]

2024-04-10 14:24:24

[

+ There are no comments

Add yours