[ad_1]

The Fed’s new coverage assertion described inflation as remaining “elevated”, and up to date quarterly financial projections confirmed the non-public consumption expenditures worth index excluding meals and vitality rising at a 2.6% charge by the top of the 12 months, in comparison with 2.4% within the projections issued in Dec.

9 of the Fed’s 19 policymakers see three quarter-point charge cuts this 12 months, and 9 see two or much less.

Just one penciled in additional cuts than the median, in contrast with 5 in Dec.

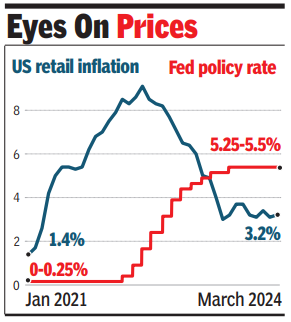

The brand new projections counsel policymakers are extra inclined to maintain charges increased for longer to ensure inflation doesn’t stall out above their 2% purpose, or flare up once more. The present coverage charge goal vary, reaffirmed on Wednesday, is 5.25-5.5%.

With a number of extra readings on inflation and the job market due earlier than the Fed’s June assembly, lots may change. Softer inflation readings may agency up expectations for the beginning of charge cuts by then. Stronger ones may push them additional into the longer term.

However at the very least thus far, hotter-than-expected worth pressures for the reason that begin of the 12 months appear to have begun to erode US central bankers’ confidence in inflation’s progress towards the two% purpose.

The S& turned marginally increased after the Fed assembly’s consequence was introduced.

[ad_2]

2024-03-20 23:11:23

[

+ There are no comments

Add yours