[ad_1]

To make certain, govt has been unambiguous in stating that there isn’t any proposal to introduce charges on UPI transactions. Final 12 months, after an RBI dialogue paper proposed a tiered construction cost on UPI funds, the finance ministry had clarified that there was no proposal to levy charges on UPI.

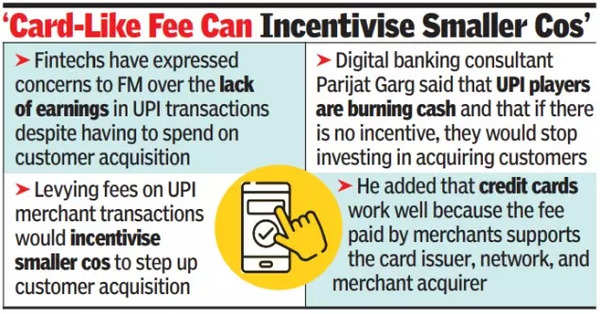

Final month, some fintech corporations expressed considerations to FM Nirmala Sitharaman in regards to the lack of earnings in UPI regardless of having to spend on buyer acquisition. In addition they raised related points in a current digital assembly with NPCI.

“Zero MDR (service provider low cost fee) consuming up enterprise fashions was some extent raised within the assembly with FM,” mentioned a fintech govt who attended the assembly.

“A few of us mentioned points associated to UPI transactions made by way of pay as you go cost devices with NPCI though there was no conclusive consequence,” mentioned one other fintech govt. NPCI declined to remark.

Walmart-owned PhonePe and Google Pay dominate 80% of UPI market, posing threat. RBI’s restrictions on Paytm result in its UPI transactions reducing from 1.4 billion to 1.3 billion in February..

One of many causes for the regulator permitting the shift of the @paytm UPI deal with from Paytm Funds Financial institution to its father or mother firm was to make sure that the lead gamers shares don’t rise additional.

Levying charges on UPI service provider transactions will incentivize smaller gamers to speed up buyer acquisition, mentioned digital banking marketing consultant Parijat Garg. “All UPI gamers are burning money. If there isn’t any incentive, why would they put money into buying clients? Bank cards work properly as a result of the MDR paid by retailers helps the cardboard issuer, community, and service provider acquirer. UPI as a system has to self -sustain itself in the long run, so there must be some inherent income fashions,” mentioned Garg. Apart from, it should additionally entice larger platforms with massive transaction volumes to enter the house. “As soon as MDR is levied, there will likely be a battle for buyer acquisition, boosting the ecosystem,” mentioned Satish Meena, advisor at market analysis agency Datum Intelligence.

[ad_2]

2024-03-11 00:58:34

[

+ There are no comments

Add yours