[ad_1]

The holding firm of the $150-billion salt-to-software conglomerate goals to restructure its steadiness sheet to keep away from a compulsory public itemizing underneath rbi‘s ‘higher layer’ NBFC norms.The ‘higher layer’ NBFC tag requires firms to comply with a stringent disciplinary construction with a compulsory itemizing inside three years of being notified.

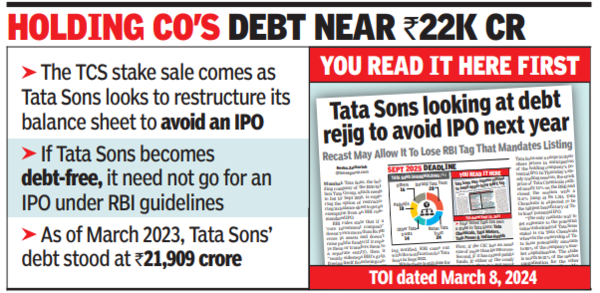

Based on Tata Sons’ FY23 report, it has debt of Rs 21,909 crore and money & financial institution balances of Rs 451 crore on its books. RBI guidelines require Tata Sons, which is registered as a core funding firm (CIC) with the banking regulator, to be listed by Sept 2025. However the firm, managed by a bunch of public foundations, Tata Trusts, has been exploring choices to keep away from the IPO. Based on RBI, for the CIC standing, a agency has to satisfy two situations: First, it has to have an asset dimension of greater than Rs 100 crore, and second, it has to have public funds. If both of the 2 situations fail, then it can’t proceed to be registered as a CIC with the regulator.

Tata Sons’ belongings are primarily its investments in working firms like TCS, Tata Motors and Tata Metal, and they’re price greater than Rs 100 crore. Based on its FY23 report, the e book worth of its investments was Rs 1.3 lakh crore. So, Tata Sons is trying to retire borrowings by changing into debt free, which can allow it to deregister as a CIC from RBI.

The transfer will assist Tata Sons to ‘neatly sidestep’ RBI’s guidelines, releasing itself from being thought-about as a CIC and an ‘higher layer’ NBFC, exempting it from going for an IPO, TOI had reported in its March 8 version. In 2017, Tata Sons had transformed itself to a privately held firm from a public one amid a boardroom battle between then chairman Cyrus Mistry and Tata Trusts.

Tata Sons has mandated international broking majors Citigroup World Markets and JP Morgan India to promote as much as 2.34 crore TCS shares, representing 0.65% of the corporate for about Rs 9,362 crore ($1.1 billion) by block offers on Tuesday. It has set a flooring worth of Rs 4,001 apiece for the TCS shares, a 3.7% low cost to the inventory’s Monday closing, time period sheet for the deal confirmed. After the transaction, Tata Sons will maintain rather less than 72% in TCS, down from 72.4% it was holding as of end-Dec 2023, shareholding knowledge on BSE proven.

As soon as this block commerce is accomplished, at an mixture worth of Rs 9,362 crore, will probably be the second largest block deal within the Indian market in 2024. Final week, international tobacco main BAT, which is the largest shareholder in ITC, bought a 3.5 % stake within the tobacco-to-FMCG main for almost Rs 17,500 crore.

At the same time as Tata Sons appears to be like to keep away from the IPO, its subsidiary Tata Capital is gearing up for an RBI-mandated IPO.

[ad_2]

2024-03-18 22:55:11

[

+ There are no comments

Add yours