[ad_1]

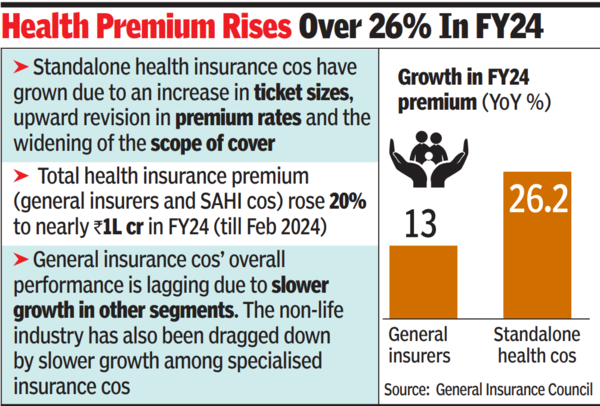

The final insurance coverage business reported an annual premium of almost Rs 2.9 lakh crore for FY24 – a couple of 13% enhance from the Rs 2.6 lakh crore reported in FY23. However, the 5 standalone medical health insurance corporations reported a 26.2% enhance in complete premium throughout the identical interval from Rs 26,243 crore to Rs 33,115 crore.These figures are primarily based on early information launched by the council.

The development of the 5 standalone medical health insurance corporations (SAHI) could be attributed to a rise in total ticket sizes, with all SAHI corporations launching high-value insurance policies that run into crores of rupees. There has additionally been a revision in premium charges to maintain up with medical inflation and the widening of the scope of canopy, insurers mentioned.

In accordance with an evaluation of Irdai’s annual report for FY23 by Emkay Finance, retail medical health insurance premiums clocked a CAGR of 20% over FY12-19, whereas the variety of folks lined recorded a CAGR of 11%. Between FY19-23, nevertheless, the premiums’ CAGR was 19% – largely led by worth hikes and sum assured will increase – and the variety of folks lined grew solely 5.9%.

For the 11 months ended Feb 2024, the entire medical health insurance premium was Rs 98,716 crore, up 20% from Rs 81,997 crore final yr. This determine contains well being premium from normal insurers and SAHI corporations. The share of medical health insurance for this era stands at 37.5%, up from 35.2% final yr.

The expansion in medical health insurance has drawn new gamers, with Star Well being founder V Jagannathan’s Galaxy Well being and Surgeon Devi Shetty’s Narayana Healthcare getting licenses.

Whereas different normal insurance coverage corporations are additionally seeing a rise in medical health insurance premium, their efficiency is dragged down by slower development in different segments like motor, officers mentioned. The business is but to launch segmented information for the complete yr. The non-life business this yr has been dragged down by slower development amongst specialised insurance coverage corporations – Agriculture Insurance coverage Firm and ECGC. Agriculture insurance coverage noticed its premium drop 32% to Rs 9,919 crore from Rs 14,619 crore final yr.

Personal insurance coverage corporations recorded a wholesome 14% development in premium at almost Rs 2.5 lakh crore in comparison with a bit over Rs 2.1 lakh crore final yr. Among the many public sector insurance coverage corporations, Oriental Insurance coverage reported the best development at 17%, whereas Nationwide Insurance coverage grew by lower than 1%. Personal insurance coverage and SAHI corporations elevated their market share by one share level.

[ad_2]

2024-04-11 22:42:52

[

+ There are no comments

Add yours