[ad_1]

Nevertheless, mid-cap schemes continued to absorb cash with the month’s internet circulation at Rs 1,018 crore. A transparent development about traders’ choice for safer haven schemes – small-caps to different less-risky plans – might emerge solely in about 3-4 months, mutual fund distributors mentioned.

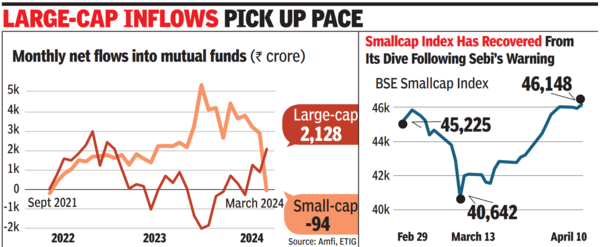

At Rs 5,472 crore, small-cap funds had recorded the largest internet influx ever in June 2023. Earlier than March 2024, the final month-to-month internet outflow was recorded in Sept 2021 at Rs 248 crore, the information confirmed.

In early March, Sebi had instructed fund homes by means of Amfi that it was involved concerning the unabated run in mid and small-cap shares and requested them to tighten their investing processes associated to those classes of schemes. It requested fund homes, for the primary time, to do a stress take a look at for a lot of these schemes to see how lengthy they might take to liquidate a serious a part of their portfolios in these schemes, in case any uncommon state of affairs pressured them to do this. Sebi’s warnings associated to mid and small-cap shares had been primarily based mostly on considerations over excessive valuations of those shares.

For a number of traders, this was a warning signal to be on the guard and a few shifted their cash out of small-cap funds and into different varieties of fairness schemes which can be perceived to be much less dangerous.

“We witnessed funding rebalancing the place traders appear to have moved from small-cap schemes to large-cap,” mentioned Manish Mehta of Kotak Mahindra MF.

Amfi information for the month additionally noticed a small uptick in gross month-to-month flows by means of the systematic funding plan route. At Rs 19,271 crore, it was the very best ever, surpassing Rs 19,187 crore taken in in Feb this yr.

The month additionally witnessed a marginal, 2% decline in whole belongings underneath administration: From Rs 54.5 lakh crore in Feb to Rs 53.4 lakh crore in March. The dip was attributed to primarily the outflows from in a single day and liquid funds, which collectively noticed internet outflow of Rs 1.6 lakh crore.

In response to Union MF CEO Madhu Nair, shorter-end fastened earnings funds are sure to see disproportionate outflows as a consequence of stability sheet build-up by institutional traders throughout the quarter and monetary year-end. “That explains the outflows in liquid funds and the shorter-end fastened earnings class in March 2024. These flows additionally come again instantly after the quarter-end,” Nair mentioned.

[ad_2]

2024-04-10 23:06:30

[

+ There are no comments

Add yours