[ad_1]

The sensex and Nifty opened the day’s session within the pink and misplaced floor via the session to shut close to their respective intraday lows. The sensex closed at 72,012 factors, down 736 factors or 1%, whereas Nifty was at 21,817 factors, down 238 factors or 1.1%.

Since its document excessive shut of 74,119 factors on March 7, the sensex has dived over 2,000 factors. The 736-point loss on Tuesday was the worst since March 13, when the index sank by over 900 factors. Globally too, shares noticed small strikes forward of the extremely anticipated US Federal Reserve resolution that can assist form the outlook for rate of interest cuts this 12 months, Bloomberg reported.

Tuesday’s slide out there got here on the again of promoting by home excessive networth buyers, market gamers mentioned. Finish-of-the-session information on BSE confirmed that whereas home funds have been web consumers at Rs 7,449 crore, international buyers too have been web consumers at Rs 1,421 crore. The day’s slide left buyers poorer by Rs 5.2 lakh crore with BSE’s market capitalization now at Rs 380.6 lakh crore.

Based on Vinod Nair of Geojit Monetary Companies, after Financial institution of Japan hiked rates of interest, the temper in Asian markets turned bearish, which pulled the Indian market to proceed with its latest southward motion.

“The correction has additionally been triggered by considerations over premium valuations and the delay of fee cuts by the US Fed as a consequence of hotter than anticipated inflation, which is clear from the upward pattern within the greenback index.” Moreover, the gradual enhance in crude oil costs can be dampening market sentimentNair mentioned.

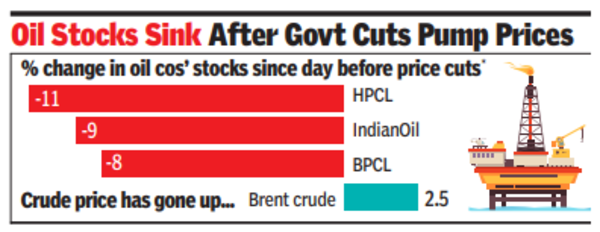

The rising crude oil costs, together with the choice by oil advertising and marketing firms (OMCs) final week to chop costs of petrol and diesel simply earlier than the announcement of the dates for the Lok Sabha polls, is weighing closely on these firms. On Thursday, OMCs reduce costs of petrol and diesel by Rs 2 per litre. By the way, crude oil costs additionally began rising from round that point.

[ad_2]

2024-03-19 22:15:32

[

+ There are no comments

Add yours