[ad_1]

On Tuesday, sensex opened the session above the 75k mark – at 75,124 factors – additionally its new all-time peak, however some profit-taking at these ranges pulled it down to shut at 74,684, down 59 factors on the day.On NSE, Nifty, too, scaled a brand new life-time peak at 22,768 factors throughout early trades however closed at 22,643, down 24 factors.

The slide was partly owing to traders’ nervousness about anticipated US inflation knowledge due Wednesday, extra so after current high-employment knowledge launched final week, stated Vinod Nair, head of analysis, Geojit Monetary Providers. An uptick in US inflation studying might delay charge cuts by its central financial institution and put international traders on the backfoot.

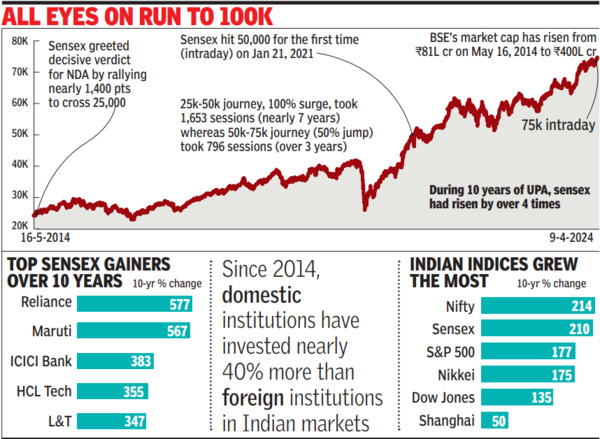

For sensex, the 75k milestone got here a day after BSE went previous a serious landmark – scaling the Rs 400-lakh-crore market capitalisation. Within the final 10 years, since Modi-led NDA authorities got here to workplace, traders’ wealth, measured by BSE’s market cap, has gone up by 5 occasions.

75,000? ‘Do not be scared by ranges. It is by no means late’

As markets attain new highs, there are traders who really feel they’ve missed the chance to create wealth.

Do not feel not noted, say funding advisors, “There is no purpose to get intimidated by the degrees of the (indices),” stated Hemant Rustagi, CEO, Wiseinvest Advisors.

Regardless of the extent at which the main indices are, they need to allocate funds primarily into three asset courses — fairness, debt and gold — and provides these property the time to develop, advisers say. “To create wealth, one ought to concentrate on three issues that are in a single’s management: The time horizon of funding, asset allocation which is in conformity with the particular person’s return-volatility urge for food and investing in good high quality property,” stated Vineet Nanda, MD, Sift Capital, a Delhi-based monetary advisory & wealth administration agency.

Monetary advisors all the time insist on the method of asset allocation for each investor. Solely the composition of the property within the portfolio might defer relying upon age. Additionally, they are saying that it isn’t ‘the timing of the market’ that is vital for wealth creation, as an alternative it is ‘the time available in the market’ that is vital.

Based on Nanda, within the present market state of affairs, large-cap shares and debt are a greater guess like gold. A change within the rate of interest cycle, via cuts in charges, is certain to generate income for traders in these property, he stated. Massive caps, however, though moderately valued are much less dangerous choices in comparison with small and mid-cap, that are adequately priced in and presently look dangerous bets.

An identical method may very well be taken by traders preferring the MF route. They may put money into massive, multi and flexi-cap schemes and keep away from mid, small-cap and sectoral funds.

[ad_2]

2024-04-09 22:51:13

[

+ There are no comments

Add yours