[ad_1]

The regulator chief’s feedback come on the again of her observations in March that some market segments had “pockets of froth”. Her statements on valuations and indicators of manipulations in some segments final month led to a correction in small-cap shares.

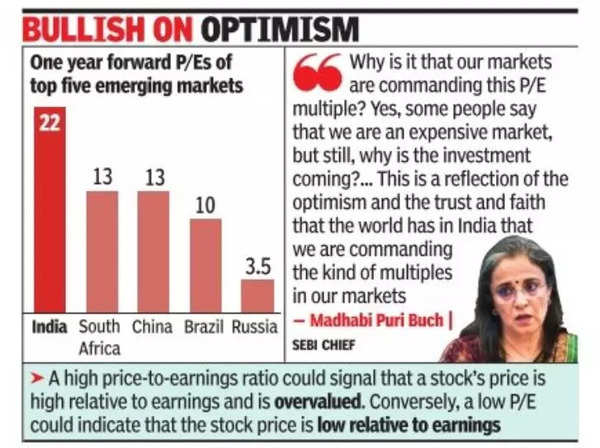

In late Jan, India overtook Hong Kong to emerge because the fourth-largest inventory market primarily based on worth of shares. There was some commentary on valuations of Indian shares being excessive. A excessive P/E ratio may sign {that a} inventory’s value is excessive relative to earnings and is overvalued. Conversely, a low P/E may point out that the inventory value is low relative to earnings.

“Why is it that our markets are commanding… this price-to-earning a number of, which is larger than not solely the averages of the world indices but in addition when put next with varied nations at 22.2? Sure, some individuals say that we’re an costly market, however nonetheless, why is the funding coming?” Buch mentioned at CII’s seventeenth annual company governance summit. She added that this was a “reflection of the optimism and the belief and religion that the world has in India in the present day that we’re commanding the type of multiples in our markets”.

The market regulator mentioned direct and oblique tax collections and power consumption knowledge indicated the financial system’s momentum. GST collections — which began at a median of Rs 1 lakh crore a month — have risen to round Rs 1.7 lakh crore in the present day, and the rise is illuminating for international traders, she mentioned. Based on Buch, these development numbers have manifested within the markets and resulted in a “hockey-stick impact”.

“In case you see the best way the market cap has grown from Rs 74 lakh crore to 1 time the GDP now — the expansion has been phenomenal in 10 years. India’s weight within the rising markets index has elevated from 6.6 to 16.6,” she mentioned.

[ad_2]

2024-04-02 22:54:17

[

+ There are no comments

Add yours