[ad_1]

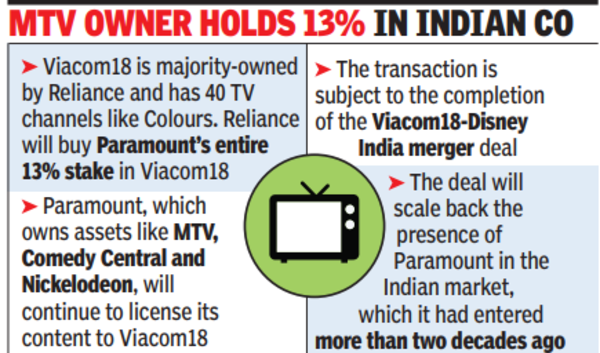

The transfer comes a fortnight after Reliance determined to merge the enterprise of Viacom18 with the India unit of Walt Disney.Reliance will purchase Paramount’s whole 13% share in Viacom 18, rising its stake to almost 70.5% from about 57.5%.

The event highlights Reliance’s technique of going past its mainstay enterprise of refining and petrochemicals and upping its play in consumer-facing companies. In direction of this, it has been shopping for belongings in retail, vogue and digital.

The deal will cut back the presence of Paramount, finest identified for proudly owning leisure belongings just like the eponymous Paramount Studios, CBS tv community, MTV, Comedy Central and Nickelodeon, in India, which it had entered greater than twenty years in the past. It’s going to, nonetheless, proceed to license its content material to Viacom18 after the deal is closed.

The transaction is topic to the completion of the Viacom18-Walt Disney India merger deal. The share-sale will assist Paramount enhance its steadiness sheet regardless that worldwide media studies have deemed it as a possible takeover goal.

In 2007, Viacom Inc (now a part of Paramount) shaped a 50:50 three way partnership with TV18 India, an organization then owned by Raghav Bahl, to ascertain Viacom18. This firm launched Hindi leisure channel Colours and managed Viacom’s TV channels like MTV, VH1 and Nickelodeon.

In 2014, TV18 India was taken over by Reliance and in 2023, Viacom 18 was mixed with one of many entities of Reliance, making Paramount a smaller shareholder of the broadcaster. The 2023 transaction additionally noticed Bodhi Tree Techniques, an funding enterprise of James Murdoch’s Lupa Techniques and former Walt Disney India head Uday Shankar, buying a 13.1% stake in Viacom18.

As soon as the companies of Viacom18 and Walt Disney India are mixed, Reliance will maintain simply over 16% within the merged entity, Viacom18 will personal about 47% and Disney near 37%.

Like Paramount, Disney too will see its presence scaled again in India, one of many largest economies on the planet.

The Reliance-Disney mixture will make the enterprise surroundings tough for smaller gamers like Zee and Sony as they should individually compete with a dominant participant. Analysts count on the Reliance-Disney consolidation to profit the unified entity as its bargaining energy will improve, serving to it to command higher promoting charges. It may additionally see rationalization in content material prices, resulting in margin enchancment, they mentioned.

Zee and Sony had tried to merge their native operations however the deal collapsed after Sony walked away from it. Had the merger occurred, Zee-Sony would have been the most important participant within the sector after Reliance-Disney.

[ad_2]

2024-03-14 22:02:34

[

+ There are no comments

Add yours