[ad_1]

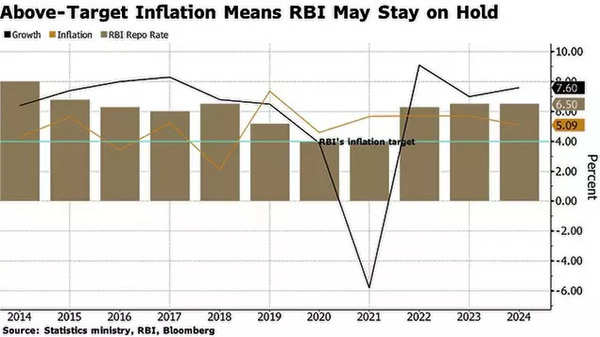

The central financial institution will doubtless hold its benchmark repurchase price at 6.5% for a seventh straight coverage assembly, based on all 39 economists surveyed by Bloomberg.Solely three of 23 analysts anticipate the central financial institution to alter its hawkish coverage stance to impartial.

The timing of any easing has been difficult although by the specter of rising meals costs and indicators of robust demand in an economic system rising shut to eight%. RBI Governor Shaktikanta Das has mentioned he would not contemplate easing till inflation settles across the 4% goal on a sustainable foundation, decreasing the probabilities of an early minimize.

The RBI is more likely to hold its price unchanged, “retain the financial coverage stance of ‘withdrawal of lodging’, sound optimistic on progress, and proceed to reiterate the dedication to the 4% headline inflation goal,” Santanu Sengupta, Goldman Sachs Group Inc .’s India economist, wrote in a current observe.

Some economists have pushed again their forecasts for price cuts to later within the 12 months. Morgan Stanley now expects the easing cycle to start by October as a substitute of June given India’s better-than-expected progress. Teresa John, an economist at Nirmal Bang Equities Pvt., pushed out her price minimize name too, citing issues that heatwaves will hold inflation excessive.

The RBI is attempting to rein in inflation whereas nonetheless conserving financial coverage supportive sufficient for the economic system, implying charges will stay secure for now. Prime Minister Narendra Modi, who’s in search of a 3rd time period in workplace in elections beginning in two weeks’ time, mentioned April 1 that progress needs to be the central financial institution’s prime precedence over the subsequent decade.

The opportunity of the US Federal Reserve delaying its price cuts additionally provides the RBI a breather. Like different rising market central banks, the RBI tends to trace Fed coverage in an effort to hold its forex secure.

What Bloomberg Economics says

The RBI’s strategy “is extra hawkish than warranted. The economic system wants stimulus. Development is slowing down. Meals costs are set to sluggish sharply towards year-end as falling agricultural prices present up in retail costs. Surging FX reserves imply the RBI needsn’t await the Fed,” Abhishek Gupta, Bloomberg Economics.

This is what to observe from the coverage assertion, which can be delivered by Das at 10 am in Mumbai on Friday:

Inflation dangers

The patron value index rose 5.09% in February from a 12 months earlier, nicely above the RBI’s goal, largely resulting from greater meals costs. The core measure, which strips out unstable meals and gas prices, has tumbled although, implying there’s little demand-push inflation within the economic system.

The voting sample of the six MPC members can be intently watched too. Jayanth Varma, an exterior committee member, was the one one calling for a price minimize within the February assembly. If others be part of him this week or vote for a change to the coverage stance, which may be an indication the RBI is able to pivot to price cuts.

Coverage stance

The RBI has maintained its hawkish stance of “withdrawal of lodging” since June 2022. Some economists say there’s an opportunity it could shift to a impartial stance now that core inflation is easing, client spending in some sectors is gentle and the federal government is reining in. its fiscal deficit.

“There’s a small chance” of the stance being modified to impartial, “but when that occurs, will probably be a optimistic shock for the market,” wrote Deutsche Financial institution AG’s India economist, Kaushik Das, in a observe.

Markets and Liquidity

India’s bonds have benefited from a gush of overseas inflows forward of their inclusion in international bond indexes and lower-than-expected authorities provide. The yield on the benchmark 10-year bond is down about 5 foundation factors this 12 months whereas comparable tenor US yields are up about 50 foundation factors.

Within the absence of any price motion, merchants will hold an in depth watch on the central financial institution’s views relating to liquidity available in the market. The RBI has change into extra nimble in its liquidity administration, including and eradicating liquidity to align the weighted common name price to the coverage repurchase price.

“RBI is anticipated to the touch upon smoothening of liquidity circumstances,” mentioned Parijat Agrawal, head of fastened revenue at Union Mutual Fund. “Systemic liquidity shall enhance going forward.”

(Updates with economists survey leads to second paragraph.)

[ad_2]

2024-04-04 04:40:14

[

+ There are no comments

Add yours