[ad_1]

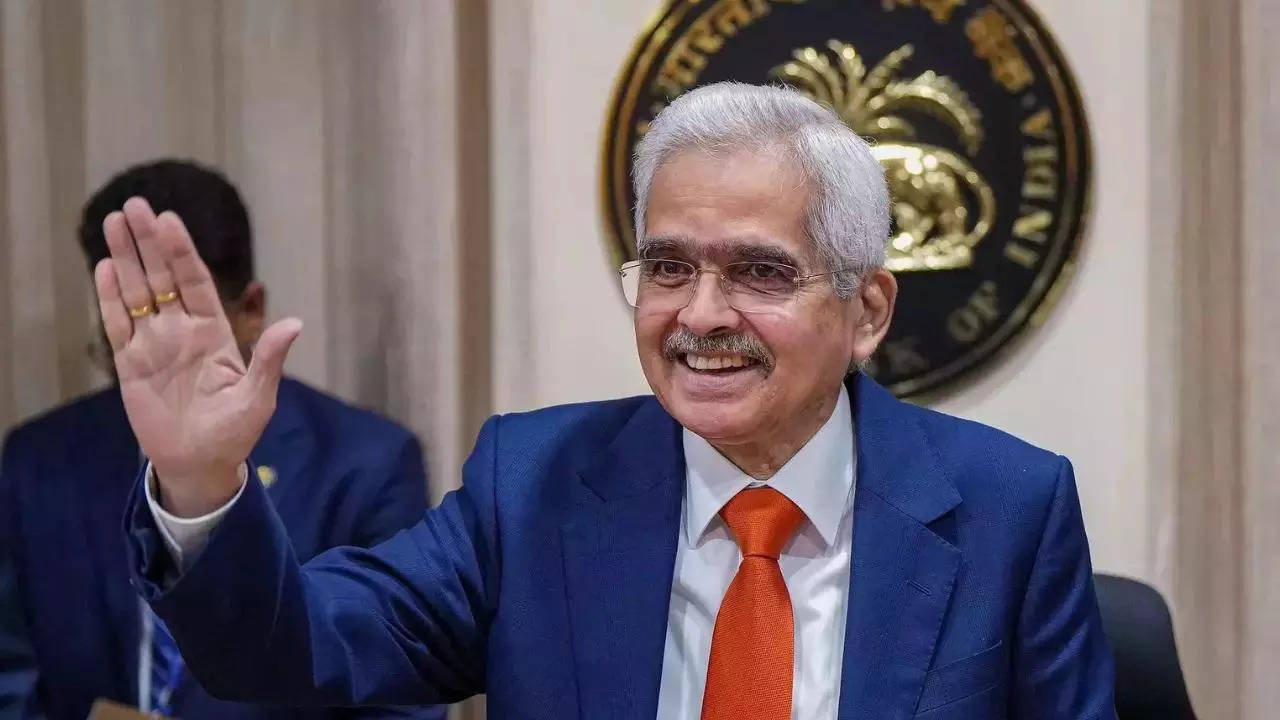

MUMBAI: RBI governor Shaktikanta Das has urged banks to extend their involvement within the rupee derivatives market, each domestically and internationally, and to make sure that retail prospects usually are not deprived within the overseas trade market. He additionally referred to as on banks to cease offering providers to unauthorized foreign exchange platforms.

“Though banks and different market members have made appreciable progress, the participation of home banks in derivatives markets stays restricted, with solely a small variety of lively market-makers.The participation of Indian banks in international markets is rising, however it’s nonetheless fairly small,” mentioned Das.

The governor’s feedback come after RBI’s crackdown on speculative buying and selling in exchange-traded overseas foreign money derivatives, which was deemed a violation of FEMA laws. In Jan, RBI acknowledged that solely these with an underlying publicity to overseas trade may take part within the derivatives market.

Das, who was talking at a convention of the Mounted Earnings and Cash Market Derivatives Sellers Affiliation (FIMMDA) in Barcelona on Monday, mentioned that home banks are coping with market-makers in international markets fairly than with finish purchasers, they usually have but to emerge as vital market-makers globally.

“Going ahead, our focus must be on enhancing and widening participation of Indian gamers in markets for rupee derivatives, each domestically and offshore, whereas being prudent,” mentioned Das. The governor additionally requested that banks shield the pursuits of small prospects when buying and selling in foreign exchange, stating that transparency in pricing continues to be a piece in progress and that extra will be performed. “Retail prospects are but to obtain a deal that is the same as that of enormous prospects,” mentioned Das.

“Though banks and different market members have made appreciable progress, the participation of home banks in derivatives markets stays restricted, with solely a small variety of lively market-makers.The participation of Indian banks in international markets is rising, however it’s nonetheless fairly small,” mentioned Das.

The governor’s feedback come after RBI’s crackdown on speculative buying and selling in exchange-traded overseas foreign money derivatives, which was deemed a violation of FEMA laws. In Jan, RBI acknowledged that solely these with an underlying publicity to overseas trade may take part within the derivatives market.

Das, who was talking at a convention of the Mounted Earnings and Cash Market Derivatives Sellers Affiliation (FIMMDA) in Barcelona on Monday, mentioned that home banks are coping with market-makers in international markets fairly than with finish purchasers, they usually have but to emerge as vital market-makers globally.

“Going ahead, our focus must be on enhancing and widening participation of Indian gamers in markets for rupee derivatives, each domestically and offshore, whereas being prudent,” mentioned Das. The governor additionally requested that banks shield the pursuits of small prospects when buying and selling in foreign exchange, stating that transparency in pricing continues to be a piece in progress and that extra will be performed. “Retail prospects are but to obtain a deal that is the same as that of enormous prospects,” mentioned Das.

[ad_2]

2024-04-08 22:23:45

[

+ There are no comments

Add yours