[ad_1]

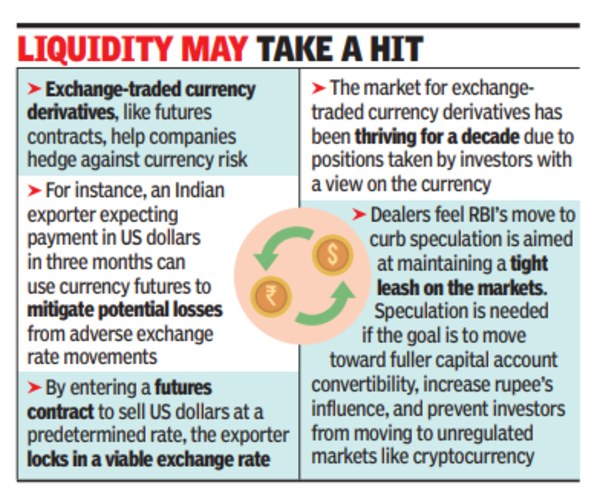

RBI’s round, which was scheduled to return into impact on April 5, stated that solely merchants with an underlying foreign exchange publicity can commerce in foreign money derivatives. Trade-traded foreign money derivatives, like futures contracts, assist firms hedge in opposition to foreign money threat.For example, an Indian exporter anticipating cost in US {dollars} in three months can use foreign money futures to mitigate potential losses from adversarial trade price actions. By coming into a futures contract to promote US {dollars} at a predetermined price, the exporter locks in a viable trade price.

The marketplace for exchange-traded foreign money derivatives has been thriving for a decade due to positions taken by buyers with a view on the foreign money. Nonetheless, RBI stated that its current round solely reiterates its current place. “The regulatory framework for exchange-traded foreign money derivatives has remained constant through the years, and there’s no change in RBI’s coverage strategy,” it stated.

The round, issued on Jan 5, retained a lot of the earlier laws, together with a requirement that trades over $100 million would require proof of publicity. This requirement of proof for larger worth trades was being interpreted by contributors to imply that those that didn’t have any publicity might take part in decrease worth transactions. Nonetheless, the Jan 5 round carried a footnote requiring exchanges to ask shoppers to commerce solely in opposition to exposures.

Sellers really feel that RBI’s transfer to curb hypothesis is aimed toward sustaining a decent leash on the markets. Nonetheless, hypothesis is required in a market if the target is to maneuver towards fuller capital account convertibility, improve rupee’s affect globally, and forestall buyers from shifting to unregulated markets like cryptocurrency.

Merchants stated that the observe successfully closed doorways for speculative trades. “RBI in a round on Jan 5, 2024 said that foreign exchange spinoff contracts involving the rupee can solely be provided ‘for the aim of hedging contracted publicity’… Efficient April 5, proprietary merchants and retail buyers can be required to show contracted or potential foreign money publicity to take part within the foreign money derivatives segments supplied by the exchanges,” HDFC Securities wrote to its prospects this week.

HDFC Securities’ communication requested prospects to sq. off all current open positions by Thursday and stated solely shoppers having legitimate underlying publicity proof are allowed to commerce within the foreign money section. On-line stockbroker Zerodha issued an identical observe to prospects.

[ad_2]

2024-04-04 20:45:58

[

+ There are no comments

Add yours