[ad_1]

Bharat Invoice Cost Systeman arm of the Nationwide Funds Company of India, will implement a brand new system of interoperable netbanking funds. This characteristic will make it simpler for smaller companies to do e-commerce, as even small fee aggregators can present this service with out on-boarding banks individually. The decrease effort for fee aggregators is anticipated to end in decrease fee costs for retailers.

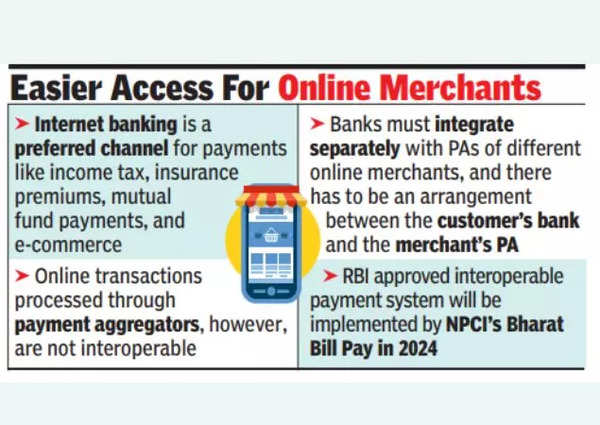

Das stated that web banking is without doubt one of the oldest modes of on-line service provider fee transactions and is a most popular channel for funds like revenue taxinsurance coverage premiums, mutual fund funds, and e-commerce.

At current, such transactions processed by way of fee aggregators usually are not interoperable. A financial institution should combine individually with every PA of various on-line retailers and there have to be an association between the shopper’s financial institution and the product owner’s PA.

“Given the a number of variety of fee aggregators, it’s troublesome for every financial institution to combine with every PA. Additional, because of the lack of a fee system and a algorithm for these transactions, there are delays in precise receipt of funds by retailers. and settlement dangers,” stated Das. The governor added that these points can be addressed with RBI’s approval for an interoperable fee system for web banking transactions, which can be carried out by NPCI’s Bharat Invoice Pay – which is to launch in 2024.

The governor spoke at RBI’s Digital Funds Consciousness Week occasion in Mumbai. Das stated retail digital funds have grown from 162 crore transactions in FY13 to 14,726 crore in FY24 (till Feb) – a 90-fold enhance in 12 years.

“At the moment, India accounts for almost 46% of the world’s digital transactions as per 2022 information. The extraordinary progress in digital funds can also be evident in RBI’s Digital Cost Index, which has witnessed a four-fold rise within the final 5 years,” stated Das.

[ad_2]

2024-03-04 20:39:21

[

+ There are no comments

Add yours