[ad_1]

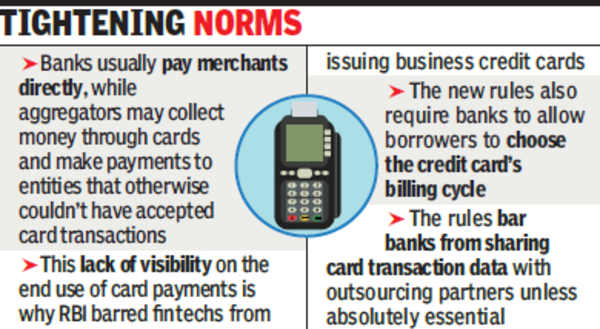

This lack of visibility on the top use of card funds was one of many causes for RBI’s latest choice to bar fintechs from issuing enterprise bank cards. This modification is a part of wider RBI card pointers aimed toward enhancing laws following the entry of fintechs and aggregators. The brand new guidelines additionally require banks to permit debtors to decide on the bank card’s billing cycle.

The brand new guidelines bar banks from sharing card transaction knowledge with outsourcing companions until it’s completely important for the associate to discharge its capabilities. “In case of sharing any knowledge as said above, express consent from the cardholder shall be obtained. It shall even be ensured that the storage and the possession of card knowledge stay with the card-issuer,” the revised norms mentioned.

There are additionally some relaxations. Banks and registered NBFCs can grow to be co-branding companions with out prior permission from the RBI. The revised provision reduces the interval for reporting the default standing to credit score info firms from “inside 30 days” to “inside 30 days from the date of settlement”. Moreover, it underscores the importance of transparently adhering to procedures, particularly in unresolved disputes.

The up to date provision reinforces the directions relating to issuing different kind elements as a substitute of conventional plastic debit/bank cards. It additionally introduces a brand new mandate for card issuers to supply mechanisms for disabling or blocking these kind elements, aligning with directives from RBI.

[ad_2]

2024-03-08 00:59:18

[

+ There are no comments

Add yours