[ad_1]

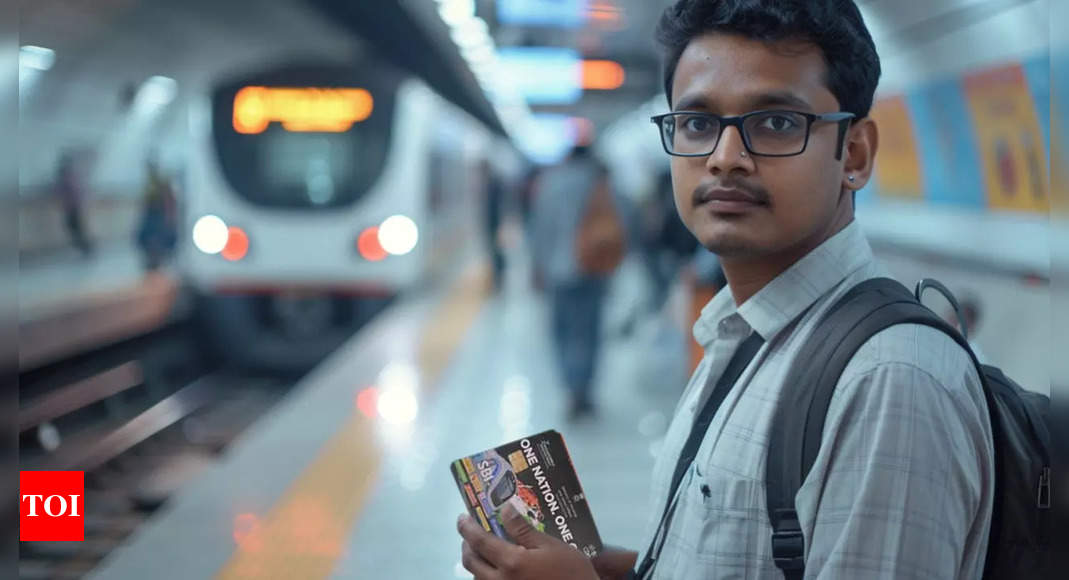

RBI eases guidelines for Nationwide Widespread Mobility Card: The Nationwide Widespread Mobility Card ,NCMC), designed to streamline digital funds throughout numerous public transport techniques in India, has seen restricted adoption thus far. Nonetheless, current regulatory adjustments could enhance its utilization sooner or later.

The Reserve Financial institution of India (RBI) has permitted the issuance of NCMC playing cards with a most restrict of Rs 3,000 with out the necessity for KYC verification.This new rule is predicted to encourage extra folks to acquire and make the most of these playing cards, states an ET report.

The RBI’s up to date guidelines enable banks and pay as you go corporations to problem NCMC playing cards with a restrict of Rs 3,000 with out KYC verification, particularly for transit funds. As soon as prospects full the KYC course of, these playing cards can be utilized for normal transactions.

Ravi Goyal, the managing director of AGS Transact, expressed optimism concerning the affect of this regulatory replace, stating that it might entice extra gamers to the market. AGS Transact, in partnership with RBL Financial institution, gives NCMC companies in Bengaluru by Ongo-branded pay as you go playing cards.

Regardless of the existence of round 200 million NCMC-enabled playing cards issued by 48 banks, the precise utilization has been restricted based on a senior banker. Not like closed-loop playing cards restricted to particular metro companies, NCMC playing cards can be utilized for funds at metros, buses, toll plazas, and gas stations, with plans to develop to commuter trains connecting suburbs to main cities.

The idea of NCMC was impressed by profitable techniques just like the Oyster playing cards in London and Octopus playing cards in Hong Kong. Nonetheless, India’s decentralized public transport system, managed by particular person state governments, has posed challenges to its fast adoption and implementation.

Additionally the current Paytm regulatory points has meant that many metro corporations that tied up with PPBL for fee companies have needed to transfer to different gamers. Delhi Metro has transitioned to Airtel Funds Financial institution following the directive to discontinue companies with PPBL. A spokesperson from Delhi Metro confirmed the change and emphasised their dedication to selling NCMC.

The Reserve Financial institution of India (RBI) has permitted the issuance of NCMC playing cards with a most restrict of Rs 3,000 with out the necessity for KYC verification.This new rule is predicted to encourage extra folks to acquire and make the most of these playing cards, states an ET report.

The RBI’s up to date guidelines enable banks and pay as you go corporations to problem NCMC playing cards with a restrict of Rs 3,000 with out KYC verification, particularly for transit funds. As soon as prospects full the KYC course of, these playing cards can be utilized for normal transactions.

Ravi Goyal, the managing director of AGS Transact, expressed optimism concerning the affect of this regulatory replace, stating that it might entice extra gamers to the market. AGS Transact, in partnership with RBL Financial institution, gives NCMC companies in Bengaluru by Ongo-branded pay as you go playing cards.

Regardless of the existence of round 200 million NCMC-enabled playing cards issued by 48 banks, the precise utilization has been restricted based on a senior banker. Not like closed-loop playing cards restricted to particular metro companies, NCMC playing cards can be utilized for funds at metros, buses, toll plazas, and gas stations, with plans to develop to commuter trains connecting suburbs to main cities.

The idea of NCMC was impressed by profitable techniques just like the Oyster playing cards in London and Octopus playing cards in Hong Kong. Nonetheless, India’s decentralized public transport system, managed by particular person state governments, has posed challenges to its fast adoption and implementation.

Additionally the current Paytm regulatory points has meant that many metro corporations that tied up with PPBL for fee companies have needed to transfer to different gamers. Delhi Metro has transitioned to Airtel Funds Financial institution following the directive to discontinue companies with PPBL. A spokesperson from Delhi Metro confirmed the change and emphasised their dedication to selling NCMC.

[ad_2]

2024-03-18 08:12:51

[

+ There are no comments

Add yours