[ad_1]

On the final buying and selling day of the monetary yr, the sensex jumped practically 1% or 655 factors to finish at 73,651- lower than 600 factors in need of its March 7 file excessive shut.

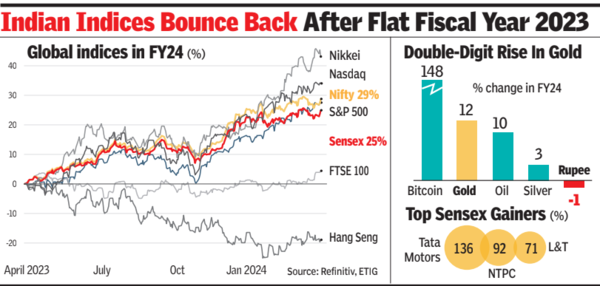

Throughout the yr as a number of of the outdated economic system firms confirmed good future prospects, traders lapped up these shares whereas the software program exporters, FMCG and personal banks witnessed muted shopping for curiosity, BSE knowledge confirmed. Among the many sensex shares, Tata Motors greater than doubled its worth whereas state-owned NTPC practically doubled. On the opposite aspect of the spectrum, HUL, Asian Paints and Kotak Mahindra Financial institution had been among the many prime laggards.

The sensex was up 25% throughout the yr whereas the broader Nifty rose 29%. Among the many sectoral indices, actual property gained 129%, utilities 93% and energy 86%. Among the many laggards had been bankex that gained 16%, FMCG 17% and monetary providers 22%, knowledge confirmed.

Though the US continued to maintain its rate of interest increased, that raised possibilities of a selloff by international funds lured by increased risk-free price away from dangerous rising markets like India, excessive weak spot within the Chinese language market labored as a blessing for the home market. Consequently, international portfolio traders internet infused Rs 2.1 lakh crore into Indian shares, the second greatest annual stream on file behind Rs 2.7 lakh crore in FY21.

The weak spot in China got here at a time when the Indian economic system confirmed sturdy resilience to a sequence of detrimental international components. “India is a most well-liked vacation spot for international flows as a result of optimistic GDP outlook, impetus on manufacturing sector and structural reforms,” stated Sanjay Bembalkar of Union MF.

[ad_2]

2024-03-28 22:59:31

[

+ There are no comments

Add yours