[ad_1]

Motilal Oswal Monetary Companies underscores that fairness markets will maintain a watch on the end result of this election, as it would have a big bearing on short-term market habits. Siddharth Khemka head (retail analysis), Motilal Oswal Monetary Companies, mentioned, Nifty has rallied 10-35% for six months (Nov-Could interval) until the announcement of election outcomes prior to now 5 consecutive Lok Sabha elections, from 1999 to 2019. “Markets are prone to stay risky heading into the elections. That being mentioned, historical past, nevertheless, is in favor of a pre-election rally,” he mentioned.

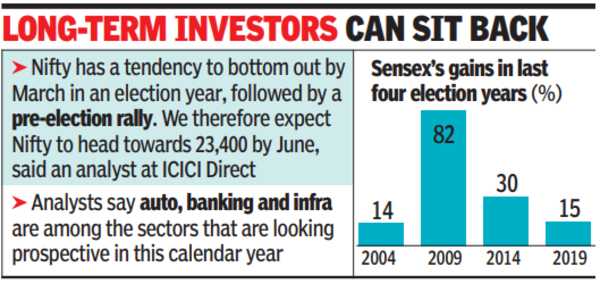

ICICI Direct famous that Indian fairness markets have given constructive returns in 9 out of the previous 11 basic election years.

“Key takeaway for traders, in our view, is that election 12 months volatility ought to be embraced as a shopping for alternative going by historic inference. Additional, Nifty tends to backside out by March within the basic election 12 months, adopted by a pre-election rally. We subsequently anticipate Nifty to go in direction of the 23,400-point mark by June 2024 with a robust assist at 21,500 ranges,” Pankaj Pandey, head of retail analysis, ICICI Direct, instructed TOI.

From a sectoral perspective for a medium to long run, he mentioned, banks have entered credit score progress cycle, which is able to result in enterprise progress and supply working leverage. “Auto is one other sector we’re bullish on, with the tailwinds from premiumisation play and EV adoption at an inflexion level,” he added.

Aside from the general public sector banks, the infrastructure sector within the railways, roads, port and highways, the place govt is driving the capital expenditure initiative, are wanting good for this calendar 12 months, mentioned Dharmesh Kant, head (fairness & by-product analysis), Cholamandalam. Finance.

“Mainly, this can be a very protected election for the markets to enter,” he mentioned. Constructing materials provides, metals, electronics and energy sectors are additionally potential winners, he mentioned.

In the meantime, in a latest assertion, Worth Shares, a smallcase supervisor, mentioned that short-term volatility nearer to election outcomes is predicted, although markets will proceed to stay sturdy over the long term.

We additionally printed the next articles not too long ago

Sensex and Nifty confirmed positive factors. Prime gainers have been HDFC Financial institution, TCS, Infosys, Maruti Suzuki, Reliance Industries. Market skilled range-bound buying and selling with mid and small-cap shares underneath stress. Varied issues have been raised by specialists concerning revenue reserving, SEBI rules, and particular market sectors.

[ad_2]

2024-03-17 22:58:20

[

+ There are no comments

Add yours