[ad_1]

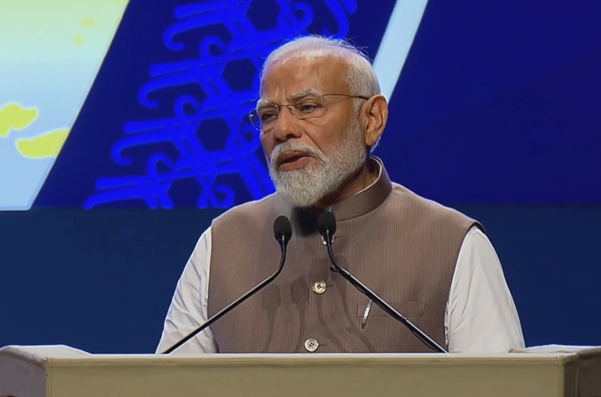

NEW DELHI: Prime Minister Narendra Modi stated India must develop into economically self sustaining inside the subsequent decade to scale back vulnerability to world influences.

Whereas addressing the ninetieth anniversary ceremony of the Reserve Financial institution of India in Mumbai on Monday, the PM stated that within the subsequent 10 years, India will try to enhance its monetary independence, with the nation’s economic system getting minimally impacted by world developments “as we’re already on the way in which to changing into a world development engine.”

He additionally highlighted the potential for job creation as soon as the BJP-led NDA authorities begins its third time period in June.

Shaktikanta Das, who was additionally current at occasion, stated that the monetary sector is secure, and GDP development is robust.

PM Modi lauds rbi

Over the following 10 years, India should try to develop into a ‘financially atmanirbhar’ economic system that’s shielded from all world occasions and continues to march forward confidently for progress and growth, PM Modi stated.

The PM stated that the nation’s economic system has risen in the previous few years from the inherited mess of 2014 when the BJP authorities took workplace, and is now poised for take-off.

“India is among the many youngest nations on the earth… Our insurance policies have opened up new sectors within the economic system like inexperienced vitality, digital know-how, Protection which is stepping into the export mode, MSMEs, area and tourism industries.

“The RBI should deal with the aspirations of the youth and develop ‘out-of-the-box’ insurance policies for all these rising sectors to assist the youth,” urged the PM.

Stating that globally there’s a problem for nations to strike a steadiness between inflation management and development, the PM known as upon the RBI to review and develop a mannequin for this, which generally is a trendsetter for the world, particularly the International South, whereas guaranteeing that the Indian Rupee is accessible and acceptable world over.

Subsequent 10 years goal

Aiming for the goal for the following 10 years, PM Modi stated that the aspirations of the youth of India should be centered and the RBI has an essential position in fulfilling this youth aspiration.

“Whereas deciding the goal for the following 10 years, we now have to maintain yet one more factor in thoughts. That’s- the aspirations of the youth of India. India is without doubt one of the youngest nations on the earth right this moment. RBI has an essential position in fulfilling this youth aspiration,” he stated.

The Prime Minister additionally stated that when the choices are proper, the insurance policies bear the fitting fruit.

“The transformation occurred as a result of there was honesty and consistency in our efforts. This modification has come as a result of our insurance policies, intentions and selections had been clear. When the intentions are clear, then the insurance policies are proper. When insurance policies are proper, then the choices are proper And when the choices are proper, the outcomes are additionally proper,” PM Modi stated.

‘Transformation of Indian banking sector is a case examine’

PM Modi additionally appreciated the federal government’s efforts to revive PSU banks, saying that the transformation of the Indian banking sector is a case examine. “We left no stone unturned for the expansion of the banking sector. The BJP authorities labored with the coverage of recognition, decision and recapitalization. To enhance the state of affairs of the general public sector banks, the BJP authorities infused capital of round Rs. 3.5 lakh crore. and likewise introduced reforms associated to governance,” the Prime Minister stated.

‘UPI has develop into a globally acknowledged platform’

Highlighting the expansion of Unified Funds Interface (UPI) within the final 10 years, PM Modi stated that India has entered a brand new period of the banking sector, economic system and foreign money change. “UPI has develop into a globally acknowledged platform. It information over 1200 crore transactions each month. In simply 10 years, we now have entered a brand new period of the banking sector, economic system and foreign money change. We’ve got to deliberate extra on the chances of digital transactions. We even have to watch the channels of a cashless economic system and make sure that we foster a financially inclusive tradition,” he stated.

‘NPAs in banks have fallen to lower than 3%’

Moreover, PM Modi stated that NPAs in banks have declined to lower than 3% in September 2023 from the file excessive of 11.25% in 2018. “The gross Non Performing Property (NPA) of the banks, which was round 11.25 per cent in 2018 , reached under 3 per cent by September 2023. The ‘twin-balance sheet’ downside is now a factor of the previous. Banks now register a credit score development of 15 per cent. RBI has performed a major position in all these accomplishments,” the Prime Minister added.

‘Ease of doing banking’

PM Modi additional harassed quick access to credit score, selling ease of banking. RBI’s financial coverage committee has labored very effectively on inflation focusing on, stated PM Modi.

“This modification has come as a result of our insurance policies, intentions, and selections had been clear. Our efforts had stability and honesty. When intentions are clear, then insurance policies are proper. When insurance policies are proper, then selections are proper. And when selections are proper, the Outcomes are additionally proper,” stated PM Modi.

About RBI

The RBI, established in 1935operates because the nation’s central financial institution as per the suggestions of the Hilton Younger Fee and is ruled by the Reserve Financial institution of India Act, 1934.

Initially led by Sir Osborne Smith, the RBI started its operations on April 1, 1935, overseeing foreign money issuance, banking companies, and rural cooperative growth.

Through the years, the RBI’s tasks have expanded to incorporate financial administration, monetary system regulation, overseas change administration, foreign money issuance, fee system oversight, and developmental capabilities.

(With inputs from companies)

Whereas addressing the ninetieth anniversary ceremony of the Reserve Financial institution of India in Mumbai on Monday, the PM stated that within the subsequent 10 years, India will try to enhance its monetary independence, with the nation’s economic system getting minimally impacted by world developments “as we’re already on the way in which to changing into a world development engine.”

He additionally highlighted the potential for job creation as soon as the BJP-led NDA authorities begins its third time period in June.

Shaktikanta Das, who was additionally current at occasion, stated that the monetary sector is secure, and GDP development is robust.

PM Modi lauds rbi

Over the following 10 years, India should try to develop into a ‘financially atmanirbhar’ economic system that’s shielded from all world occasions and continues to march forward confidently for progress and growth, PM Modi stated.

The PM stated that the nation’s economic system has risen in the previous few years from the inherited mess of 2014 when the BJP authorities took workplace, and is now poised for take-off.

“India is among the many youngest nations on the earth… Our insurance policies have opened up new sectors within the economic system like inexperienced vitality, digital know-how, Protection which is stepping into the export mode, MSMEs, area and tourism industries.

“The RBI should deal with the aspirations of the youth and develop ‘out-of-the-box’ insurance policies for all these rising sectors to assist the youth,” urged the PM.

Stating that globally there’s a problem for nations to strike a steadiness between inflation management and development, the PM known as upon the RBI to review and develop a mannequin for this, which generally is a trendsetter for the world, particularly the International South, whereas guaranteeing that the Indian Rupee is accessible and acceptable world over.

Subsequent 10 years goal

Aiming for the goal for the following 10 years, PM Modi stated that the aspirations of the youth of India should be centered and the RBI has an essential position in fulfilling this youth aspiration.

“Whereas deciding the goal for the following 10 years, we now have to maintain yet one more factor in thoughts. That’s- the aspirations of the youth of India. India is without doubt one of the youngest nations on the earth right this moment. RBI has an essential position in fulfilling this youth aspiration,” he stated.

The Prime Minister additionally stated that when the choices are proper, the insurance policies bear the fitting fruit.

“The transformation occurred as a result of there was honesty and consistency in our efforts. This modification has come as a result of our insurance policies, intentions and selections had been clear. When the intentions are clear, then the insurance policies are proper. When insurance policies are proper, then the choices are proper And when the choices are proper, the outcomes are additionally proper,” PM Modi stated.

‘Transformation of Indian banking sector is a case examine’

PM Modi additionally appreciated the federal government’s efforts to revive PSU banks, saying that the transformation of the Indian banking sector is a case examine. “We left no stone unturned for the expansion of the banking sector. The BJP authorities labored with the coverage of recognition, decision and recapitalization. To enhance the state of affairs of the general public sector banks, the BJP authorities infused capital of round Rs. 3.5 lakh crore. and likewise introduced reforms associated to governance,” the Prime Minister stated.

‘UPI has develop into a globally acknowledged platform’

Highlighting the expansion of Unified Funds Interface (UPI) within the final 10 years, PM Modi stated that India has entered a brand new period of the banking sector, economic system and foreign money change. “UPI has develop into a globally acknowledged platform. It information over 1200 crore transactions each month. In simply 10 years, we now have entered a brand new period of the banking sector, economic system and foreign money change. We’ve got to deliberate extra on the chances of digital transactions. We even have to watch the channels of a cashless economic system and make sure that we foster a financially inclusive tradition,” he stated.

‘NPAs in banks have fallen to lower than 3%’

Moreover, PM Modi stated that NPAs in banks have declined to lower than 3% in September 2023 from the file excessive of 11.25% in 2018. “The gross Non Performing Property (NPA) of the banks, which was round 11.25 per cent in 2018 , reached under 3 per cent by September 2023. The ‘twin-balance sheet’ downside is now a factor of the previous. Banks now register a credit score development of 15 per cent. RBI has performed a major position in all these accomplishments,” the Prime Minister added.

‘Ease of doing banking’

PM Modi additional harassed quick access to credit score, selling ease of banking. RBI’s financial coverage committee has labored very effectively on inflation focusing on, stated PM Modi.

“This modification has come as a result of our insurance policies, intentions, and selections had been clear. Our efforts had stability and honesty. When intentions are clear, then insurance policies are proper. When insurance policies are proper, then selections are proper. And when selections are proper, the Outcomes are additionally proper,” stated PM Modi.

About RBI

The RBI, established in 1935operates because the nation’s central financial institution as per the suggestions of the Hilton Younger Fee and is ruled by the Reserve Financial institution of India Act, 1934.

Initially led by Sir Osborne Smith, the RBI started its operations on April 1, 1935, overseeing foreign money issuance, banking companies, and rural cooperative growth.

Through the years, the RBI’s tasks have expanded to incorporate financial administration, monetary system regulation, overseas change administration, foreign money issuance, fee system oversight, and developmental capabilities.

(With inputs from companies)

[ad_2]

2024-04-01 06:12:38

[

+ There are no comments

Add yours