[ad_1]

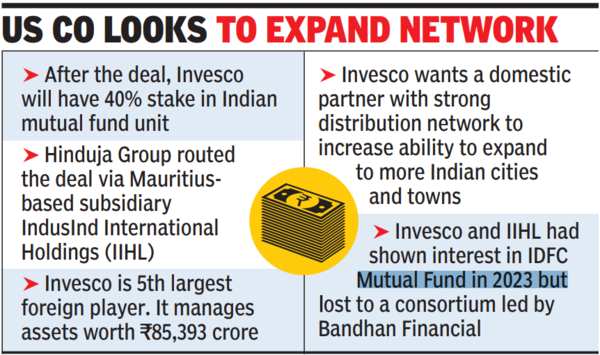

The transfer comes after the bank-to-automobile conglomerate received a court docket approval for buy of Reliance Capital and its subsidiaries, overlaying life, well being and normal insurance coverage, analysis and securities broking and asset reconstruction companies.Hinduja and Invesco did not disclose the deal. quantity however mentioned after the transaction, the US agency will retain a 40% stake within the mutual fund unit.

Invesco, which entered the nation’s MF trade via a stake-purchase in Religare Asset Administration in 2012, is right now the fifth largest overseas participant. It manages belongings value Rs 85,393 crore. It had purchased 49% in Religare for about Rs 460 crore and 4 years later bought the remaining 51% stake.

Hinduja Group has routed the deal via its Mauritius primarily based arm IndusInd Worldwide Holdings (IIHL). In November 2023, IIHL chairman Ashok Hinduja had advised TOI that there are gaps within the firm’s monetary providers enterprise like mutual funds, which it’ll refill via acquisitions.

IIHL, which has greater than 600 shareholders, owns IndusInd Financial institution and Reliance Capital in India, Sterling Financial institution & Belief in Bahamas, Afrinex Change in Mauritius and Beryllus Capital in UK, Switzerland and Singapore. Hinduja had then mentioned there are a lot of shareholders, who wish to exit IIHL and the plan is to do an preliminary public supply of IIHL in an abroad jurisdiction.

On Tuesday, after inking the take care of Invesco, Hinduja mentioned: “That is one other step in journey of worth creation for our shareholders. It was our imaginative and prescient to remodel IIHL right into a BFSI powerhouse.”

Invesco is ceding majority management of the India mutual fund unit because it wished a home companion with robust distribution community. The native arm has additionally been beneath the scanner of market regulator Sebi for alleged violations of mutual fund guidelines. A “robust home companion” will enhance the flexibility to develop to extra Indian cities and cities, that are driving trade progress, mentioned Invesco Asset Administration India CEO Saurabh Nanavati.

In 2023, each Invesco and IIHL had proven curiosity in shopping for IDFC Mutual Fund however then misplaced it to a consortium led by Bandhan Monetary. The take care of IIHL excludes invesco‘s enterprise help providers middle in Hyderabad that employs greater than 1,700 individuals. The Hinduja-Invesco deal comes at an “opportune time” with India’s rising prosperity, favorable demographics and financialisation of financial savings into capital markets providing monumental prospects.

[ad_2]

2024-04-09 23:23:47

[

+ There are no comments

Add yours