[ad_1]

In March, total collections throughout the month had been pushed by home demand as central and state gst collections grew 16.9% and 17.2%, respectively.

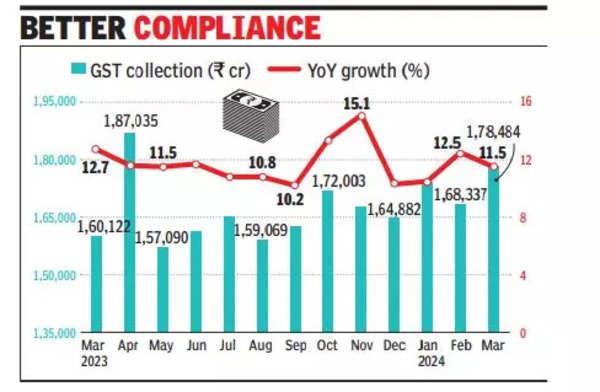

‘Report GST collections present eco resurgence throughout sectors’

Built-in GST mop-up, levied on inter-state transactions and imports, rose 6.1% to Rs 87,947 crore. A key cause for this was a fall in income from imports, which declined 5.1% at Rs 40,322 crore.

“Report collections throughout FY24 exhibit the financial resurgence throughout sectors and was potential as a result of varied measures taken by GST authorities to enhance compliance and stamp out evasion. The large deal with comparability of taxpayer conduct throughout tax and company databases has additionally satisfied companies on the have to be compliant not solely on their actions, but additionally maintain observe of their distributors’ tax conduct and be sure that the complete worth chain turns into compliant. Since all main states have recorded double-digit development in GST collections – collections being additionally a barometer for financial actions as it is a transaction-based tax – it may be moderately inferred that the expansion is throughout areas and sectors,” stated companion MS Mani, at Deloitte India.

In March, barring Mizoram (29% fall), all states and Union territories with legislatures reported a pointy enhance. On an total foundation, tax consultants see this pattern persevering with. “The double-digit development continues in month-to-month GST collections over final yr. With this pattern, it is not going to be shocking if the goal for FY25 is revised when the principle Union Finances is introduced after the formation of a brand new govt. Additionally, the collections , that are solely prone to be higher in coming months, might pave the best way for the subsequent wave of GST reforms, together with charge rationalization,” stated Pratik Jain, PwC companion India.

[ad_2]

2024-04-01 23:47:51

[

+ There are no comments

Add yours