[ad_1]

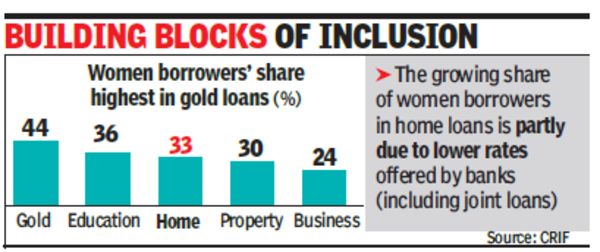

The rising share of ladies debtors in house loans is not less than partly as a result of decrease charges provided by banks (together with joint loans). Moreover selling inclusion, which means that properties are collectively registered, offering added safety to lenders.

Girls account for 16% of private loans, in comparison with 15% within the earlier yr and 43% of gold loans – an increase from 41% within the year-ago interval. In training loans, 36% of all lively accounts are of ladies, up from 35% a yr in the past. Regardless of the growing illustration of ladies amongst debtors in important sectors, their proportion within the variety of lively retail loans has declined. Their share within the whole worth of loans, nevertheless, has remained regular over the previous 12 months concluding in Dec 2023.

The drop in girls’s share stems from the enterprise mortgage section, the place the ratio of women-men debtors has dropped to 38:62 from 40:60 a yr in the past. In consequence, share of ladies within the total quantity of retail loans has fallen to 24% from 25% a yr in the past.

By the way, after gold loans, the share of ladies debtors is highest in small enterprise loans, the place girls represent 43% of the debtors. The portfolio excellent for ladies debtors in two-wheeler and private loans elevated 26% year-on-year. Private loans noticed a 52% annual improve in lively loans, whereas property loans grew by 39%.

Retail mortgage portfolio reached Rs 117.4 lakh crore in Dec, up from Rs 100.3 lakh crore within the yr earlier than – a 17% year-on-year progress. Girls debtors’ share in retail loans remained secure at round 26%. Energetic girls debtors rose to 7.8 crore in Dec, up from 6.7 crore a yr in the past, with a 17.8% year-on-year progress. Male debtors with lively loans elevated to twenty.2 crore from 17.8 crore in Dec 2022, with a 13.1% year-on-year progress.

By way of quantity of loans, the enterprise mortgage section accounts for six% of the overall 59.6 crore retail loans. The most important retail section in quantity of accounts is private loans (18% of retail loans), the place the share of ladies debtors has elevated to 16% from 15%. In worth phrases, share of ladies in total retail loans of Rs 117.3 lakh crore has remained unchanged at 26%.

[ad_2]

2024-03-07 23:24:54

[

+ There are no comments

Add yours