[ad_1]

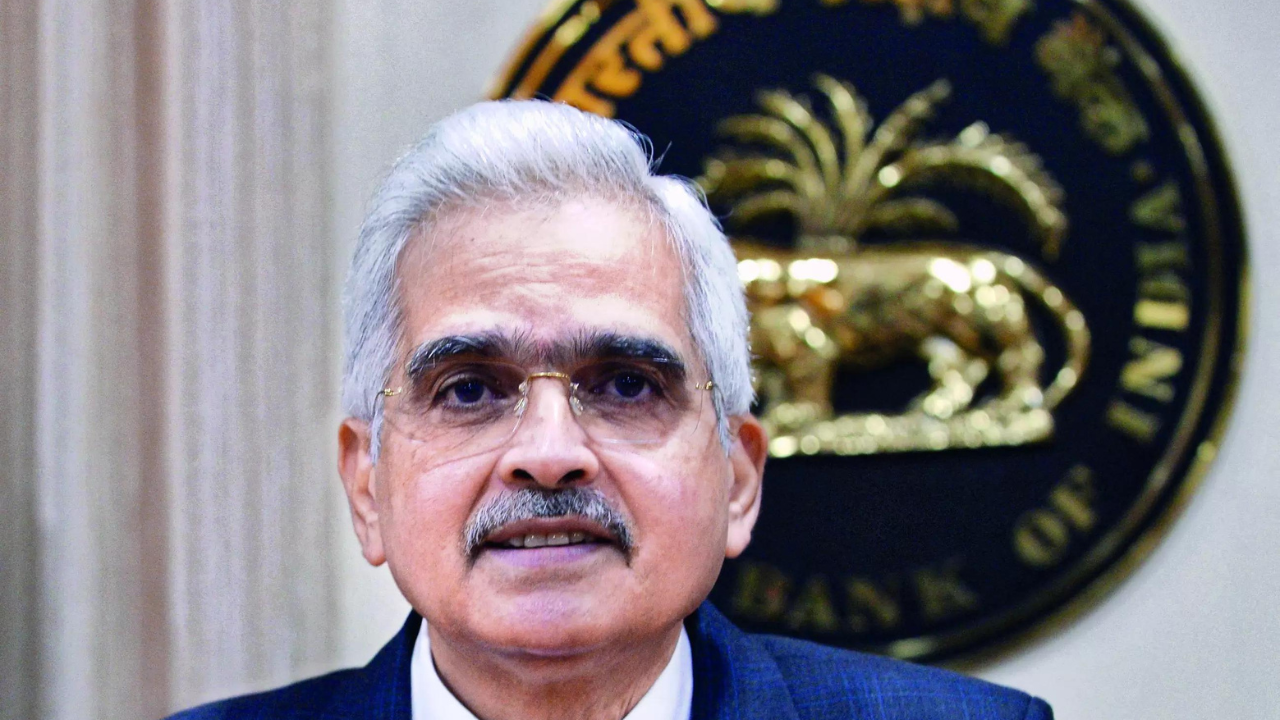

MUMBAI: Evaluating India’s progress momentum with Tejas fight plane, RBI governor Shaktikanta Das on Wednesday mentioned the financial system may develop round 8% this 12 months, larger than the 7.6% estimated by the Nationwide Statistical Workplace.

“Our sense and understanding of excessive frequency indicators and momentum of financial exercise tells us that this 5.9% progress forecast for This fall might be exceeded.When that occurs, progress in FY24 shall be greater than 7.6%”. progress being shut to eight%,” Das instructed ET NOW, including that the financial system may develop round 7% subsequent 12 months.

He mentioned general rural demand is displaying indicators of enchancment whereas remaining sturdy in city areas. Apart from, different financial metrics resembling non-public funding, capability utilization and financial institution credit score progress are displaying an uptick.

On current restrictions imposed on Paytm Funds Financial institution, the governor mentioned the March 15 deadline for imposing restrictions on deposits was enough and urged shoppers – who’re solely linked to the controversial entity – to hyperlink their accounts with different gamers.

“About 80-85% of Paytm Funds Financial institution customers are linked to different banks, together with Paytm financial institution or different lenders. Their funds will go on in a non-disruptive method. The problem is with these 15-20% customers. These prospects are getting onboarded to different banks.”

He additionally mentioned RBI remained absolutely supportive of fintech and reiterated his concern over cryptocurrency, arguing they’ve “no underlying” and are “speculative”.

“Our sense and understanding of excessive frequency indicators and momentum of financial exercise tells us that this 5.9% progress forecast for This fall might be exceeded.When that occurs, progress in FY24 shall be greater than 7.6%”. progress being shut to eight%,” Das instructed ET NOW, including that the financial system may develop round 7% subsequent 12 months.

He mentioned general rural demand is displaying indicators of enchancment whereas remaining sturdy in city areas. Apart from, different financial metrics resembling non-public funding, capability utilization and financial institution credit score progress are displaying an uptick.

On current restrictions imposed on Paytm Funds Financial institution, the governor mentioned the March 15 deadline for imposing restrictions on deposits was enough and urged shoppers – who’re solely linked to the controversial entity – to hyperlink their accounts with different gamers.

“About 80-85% of Paytm Funds Financial institution customers are linked to different banks, together with Paytm financial institution or different lenders. Their funds will go on in a non-disruptive method. The problem is with these 15-20% customers. These prospects are getting onboarded to different banks.”

He additionally mentioned RBI remained absolutely supportive of fintech and reiterated his concern over cryptocurrency, arguing they’ve “no underlying” and are “speculative”.

[ad_2]

2024-03-06 23:46:21

[

+ There are no comments

Add yours