[ad_1]

Tax advantages of hybrid funds: Because the monetary yr involves an finish, it is vital to maintain a tab in your tax outgo for FY 2023-24. Wealth managers advise conservative traders to contemplate hybrid schemes earlier than the monetary yr ends to avoid wasting on taxes in mutual fund investmentsstates an ET report.

The federal government’s elimination of indexation advantages for pure debt schemes in Price range 2023-24 makes hybrid funds with 35% to 65% fairness allocation a viable choice.

Indexation, which adjusts inflation with the asset’s value, lowers tax legal responsibility. Sure schemes like balanced hybrid, multi-asset, and dynamic asset allocation nonetheless provide indexation advantages.

Traders buying these schemes earlier than March 31 and holding them until April 1, 2027, can pay a 20% long-term capital good points tax with indexation advantages, gaining an additional yr’s benefit.

Viral Bhatt, founding father of Cash Mantra, means that shifting funds from financial institution deposits to such schemes can improve post-tax returns for low-risk traders.

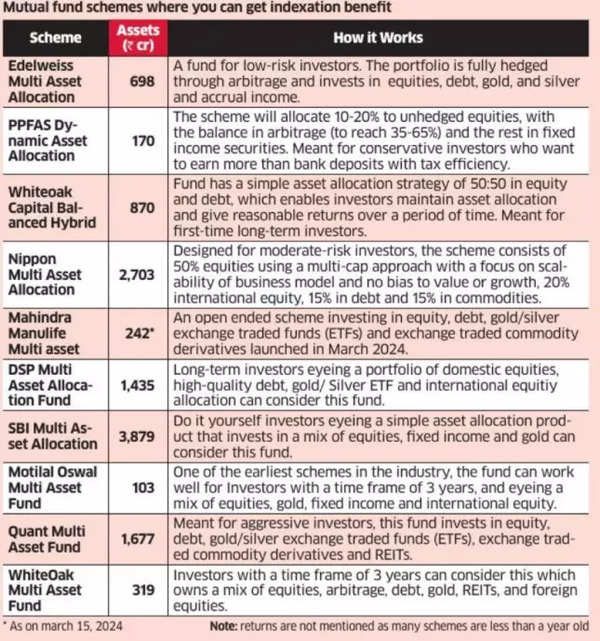

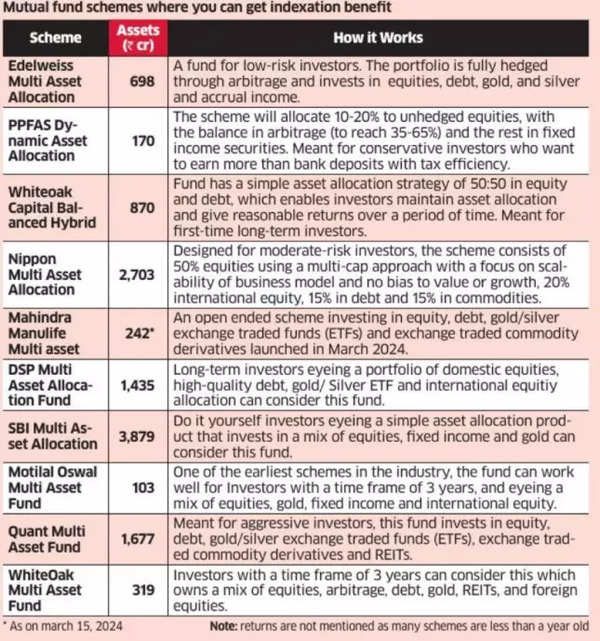

This is a take a look at mutual fund schemes the place you will get indexation advantages:

The federal government’s elimination of indexation advantages for pure debt schemes in Price range 2023-24 makes hybrid funds with 35% to 65% fairness allocation a viable choice.

Indexation, which adjusts inflation with the asset’s value, lowers tax legal responsibility. Sure schemes like balanced hybrid, multi-asset, and dynamic asset allocation nonetheless provide indexation advantages.

Traders buying these schemes earlier than March 31 and holding them until April 1, 2027, can pay a 20% long-term capital good points tax with indexation advantages, gaining an additional yr’s benefit.

Viral Bhatt, founding father of Cash Mantra, means that shifting funds from financial institution deposits to such schemes can improve post-tax returns for low-risk traders.

This is a take a look at mutual fund schemes the place you will get indexation advantages:

Mutual fund schemes the place you will get indexation advantages

[ad_2]

2024-03-19 02:55:13

[

+ There are no comments

Add yours