[ad_1]

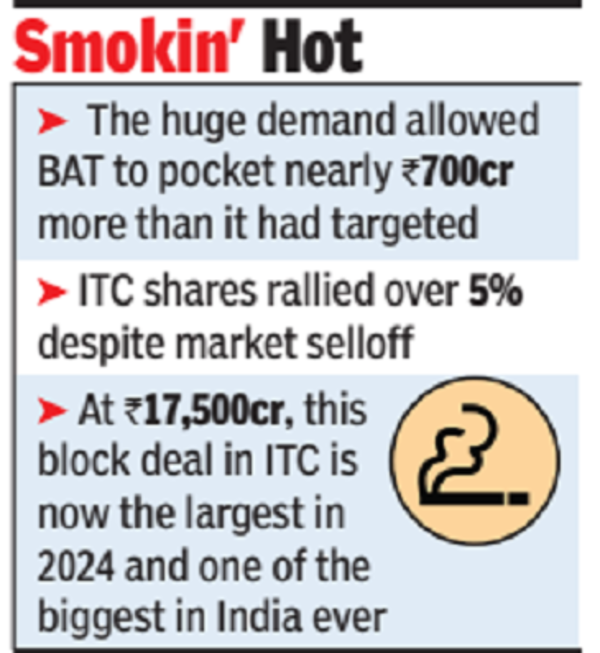

The massive demand allowed BAT to pocket almost Rs 17,500 crore (virtually $2.1 billion), about Rs 700 crore ($80 million) greater than the Rs 16,800 crore ($2 billion) it had initially focused to mop up.BAT’s block of 43.7 crore ITC shares. was offered at a mean worth of Rs 400.25 per share, on the higher finish of the Rs 384-400.25 worth band.

Govt of Singapore was the most important purchaser of the block that picked up almost 9.2 crore ITC shares, BSE information confirmed. Different reputed international funds included Goldman Sachs, HSBC, Blackstone, Aberdeen, The World Financial institution, Citigroup, Morgan Stanley, Capital Group, Peoples Financial institution of China and lots of others. Among the many home funds had been SBI MF, HDFC MF, Birla MF, Kotak MF, HDFC Life Insurance coverage, I-Pru Life Insurance coverage and others.

Normally block trades are completed at a reduction to the market worth. Nevertheless, given the sturdy demand for ITC shares from institutional buyers, these blocks had been offered on the higher finish of the worth band. Consequently, quickly after the block deal was accomplished, ITC shares rallied over 5% regardless of Wednesday’s market sell-off, and closed at Rs 422 – up 4.5% on the day.

London-based BAT had mandated BofA Securities India and Citigroup International Markets India collectively to promote the block. On Tuesday, BAT had introduced that when it sells a part of its stake in ITC, it should “stay a major shareholder of ITC, with (about) 25.5% holding.” The UK firm intends to make use of a part of its proceeds from the ITC stake sale to pay dividends this yr and the subsequent.

As of Dec 2023, BAT was holding somewhat over 29% stake in ITC. After this stake sale, its holding might be lowered to 25.5%. For about 3-4 months now, the highest administration at BAT has been speaking about monetising a part of the British MNC’s stake in ITC, supplied it might efficiently navigate India’s strict international holding guidelines in tobacco corporations. From the very starting, BAT had indicated that its holding in ITC wouldn’t fall beneath the strategically necessary 25% mark.

Final yr, ITC had introduced that it will demerge its inns enterprise. At Rs 17,500 crore, this block deal in ITC is now the most important in 2024 and one of many largest within the Indian inventory market historical past.

[ad_2]

2024-03-13 21:49:37

[

+ There are no comments

Add yours