[ad_1]

Among the many sensex constituents, Axis Financial institution, Bharti Airtel and ICICI Financial institution contributed probably the most to the day’s positive factors, whereas promoting in shares like NTPC and UltraTech Cement restricted positive factors to some extent, BSE information confirmed.

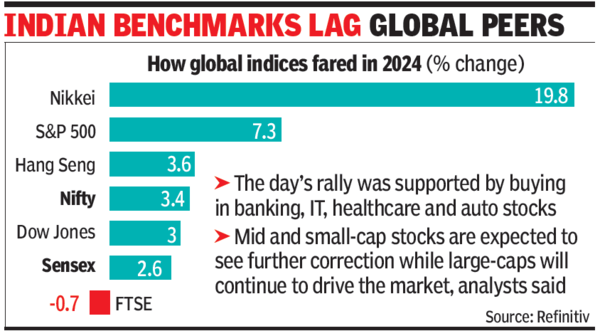

In line with Siddhartha Khemka, head (retail analysis), Motilal Oswal Monetary Providers, home equities made a comeback after a minor pause and continued to make new highs. “Optimistic up-move was supported by shopping for in shares from banking, IT, healthcare and auto sectors. The broader market, nonetheless, continued to witness promoting, with Nifty Midcap 100 down 0.5% and Nifty Smallcap 100 down 2%.”

Going forward, center and small-cap shares are anticipated to witness correction.

“We anticipate large-caps to drive the market within the close to time period whereas mid-cap and small-cap shares might stay beneath strain,” Khemka wrote in his post-market notice.

The affect of heavy promoting in shares outdoors of sensex and Nifty was seen within the dip in buyers’ wealth. Regardless of the upward transfer in main indices, BSE’s market cap dipped by Rs 1.6 lakh crore to Rs 398 lakh crore, official information confirmed.

The day’s shopping for in large-caps was equally helped by overseas and home funds, BSE information confirmed. Whereas overseas funds had been web consumers at Rs 2,767 crore, home establishments had been web consumers at Rs 2,150 crore.

In Thursday’s session, there may very well be some constructive response to US Federal Reserve chair Jerome Powell’s assertion that the central financial institution might go for a fee minimize later within the 12 months. In early trades within the US on Wednesday, most main indices in addition to authorities bonds had been up.

Mahindra promoter’s arm to promote 0.8% in firm

Prudential Administration & Providers, a promoter group entity of the auto main Mahindra & Mahindra will promote about 0.8% of the corporate by block offers on Thursday, sources mentioned. Promoters at the moment maintain 19.3% within the firm, BSE information confirmed. The promoters will obtain about Rs 1,778 crore (about $215 million) by this deal.

[ad_2]

2024-03-06 22:53:01

[

+ There are no comments

Add yours