[ad_1]

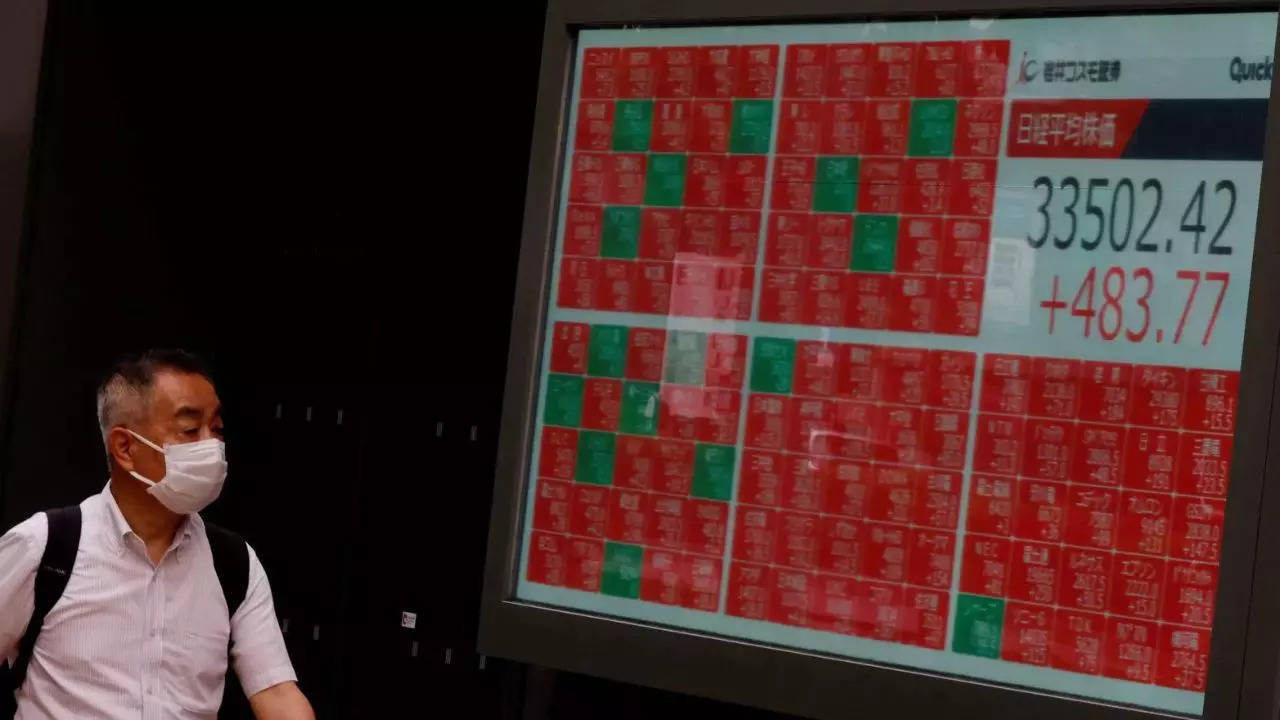

TOKYO: Japan‘s benchmark Nikkei The index surpassed the 40,000 mark for the primary time on Monday following positive factors on wall road,

The Nikkei added 0.84 %, or 334.87 factors, to 40,245.69 shortly after the opening bell, whereas the broader Topix index rose 0.30 % or 8.07. factors to 2,717.49.

The greenback stood at 150.04 yen, in contrast with 150.11 yen seen Friday in New York.

Tokyo and different main world shares have steadily gained since final 12 months, and analysts predict the Nikkei ought to acquire even additional, lifted by rallying Wall Road, strong company earnings and powerful hopes for AI applied sciences.

“The sturdy efficiency of world fairness markets, together with the MSCI World, Japanese Nikkei 225, Nasdaq, and S&P 500 indexes, which all closed at document highs final week, present favorable commerce winds for Asian markets as the brand new week begins on Monday,” Stephen Innes of SPI Asset Administration stated.

“The constructive sentiment is pushed by a number of elements, together with the hope for US rate of interest cuts, indicators of cooling inflation, and a surge in curiosity surrounding synthetic intelligence throughout the large tech sector,” he stated.

“These elements collectively contribute to the constructive tone in world markets, which is predicted to bolster Asian markets and encourage confidence amongst traders as they begin buying and selling for the week,” he stated.

On February 22 the Nikkei lastly broke via a document excessive set simply earlier than an asset bubble in Japan catastrophically burst within the early Nineties.

Amongst main shares, high-tech investor SoftBank Group jumped 2.60 % to 9,139 yen.

Semiconductor shares rallied, including to current sturdy positive factors.

Tokyo Electron roared 3.15 % to 39,590 yen. Advantest surged 2.65 % to 7,308 yen.

Industrial robotic maker Fanuc added 1.60 % to 4,521 yen.

However Toyota gave up early positive factors and dropped 1.06 % to three,641 yen in early commerce, as did Sony Group, which misplaced 0.91 % to 13,095 yen.

The Nikkei added 0.84 %, or 334.87 factors, to 40,245.69 shortly after the opening bell, whereas the broader Topix index rose 0.30 % or 8.07. factors to 2,717.49.

The greenback stood at 150.04 yen, in contrast with 150.11 yen seen Friday in New York.

Tokyo and different main world shares have steadily gained since final 12 months, and analysts predict the Nikkei ought to acquire even additional, lifted by rallying Wall Road, strong company earnings and powerful hopes for AI applied sciences.

“The sturdy efficiency of world fairness markets, together with the MSCI World, Japanese Nikkei 225, Nasdaq, and S&P 500 indexes, which all closed at document highs final week, present favorable commerce winds for Asian markets as the brand new week begins on Monday,” Stephen Innes of SPI Asset Administration stated.

“The constructive sentiment is pushed by a number of elements, together with the hope for US rate of interest cuts, indicators of cooling inflation, and a surge in curiosity surrounding synthetic intelligence throughout the large tech sector,” he stated.

“These elements collectively contribute to the constructive tone in world markets, which is predicted to bolster Asian markets and encourage confidence amongst traders as they begin buying and selling for the week,” he stated.

On February 22 the Nikkei lastly broke via a document excessive set simply earlier than an asset bubble in Japan catastrophically burst within the early Nineties.

Amongst main shares, high-tech investor SoftBank Group jumped 2.60 % to 9,139 yen.

Semiconductor shares rallied, including to current sturdy positive factors.

Tokyo Electron roared 3.15 % to 39,590 yen. Advantest surged 2.65 % to 7,308 yen.

Industrial robotic maker Fanuc added 1.60 % to 4,521 yen.

However Toyota gave up early positive factors and dropped 1.06 % to three,641 yen in early commerce, as did Sony Group, which misplaced 0.91 % to 13,095 yen.

[ad_2]

2024-03-04 00:50:11

[

+ There are no comments

Add yours