[ad_1]

The sturdy economic system has been a key consider boosting sentiment throughout the board together with the inventory market, The Oct-Dec quarter GDP development was estimated at 8.4%, manner above market expectations.

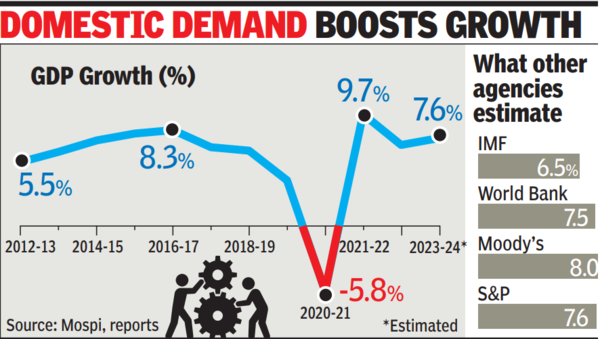

Indicators of a restoration had been seen after the lifting of Covid-induced curbs with a number of indicators gathering momentum driving on strong home demand.The economic system grew at its quickest tempo in six quarters within the three months to Dec, led by sturdy manufacturing and development sector development, prompting the statistics workplace to mission a 7.6% development for the total 12 months, above the sooner estimate of seven.3%. Since then a number of businesses have raised their development estimates for India which is seen as the following driver of world development amid the gloomy outlook for main economies.

Finance minister Nirmala Sitharaman has indicated that the economic system is anticipated to develop 8% or extra within the Jan-Mar quarter pushed by improved inflation administration and general macroeconomic stability.

A number of indicators for the reason that launch of the Dec quarter GDP estimates have additionally pointed to higher resilience of the economic system. PMI surveys for manufacturing and companies have each touched document highs highlighting the power of demand. Rural consumption, which has been a supply of fear, has proven indicators of selecting up tempo and may augur nicely for general development.

There are a number of issues going for India. As an illustration, the slowdown in China and its property and inventory market woes have centered the world’s consideration on India. That is mirrored in increased inflows out there. Inflation which has emerged as a problem appears to have slowed for now after RBI raised rates of interest to tame worth pressures. There are expectations that the central financial institution will lower charges round July-Aug though world crude oil costs which have surged following tensions within the Center East have emerged as a threat for inflation administration for now.

[ad_2]

2024-04-09 23:10:39

[

+ There are no comments

Add yours